By Yuxiang Hou, College of William and Mary

This paper attempts to revisit “the end of geography” debate by incorporating both established theoretical frameworks and the latest empirical evidence. It argues that for five reasons—the unchanged landscapes of specific places, the involvement of physical goods transmission, certain types of customers, the importance of energy support and local-level financial information networks—finance is not making geography increasingly insignificant. However, in the long run, things may be different.

1. Introduction

The end of geography topic has sparked a series of heated debates in academia in recent decades. The primary beginning of the debate dates back to the publication of Richard O’Brien’s book Global Financial Integration: The End of Geography in 1992. In this book, O’Brien describes many facets of economic geography that he believed would be challenged by the end of geography, including deregulation, which consists of national liberalization and deregulation in economic management, and possible wider economic and political integration. However, the most influential and controversial theme in this book is the relationship between technology and location, as O’Brien claimed in the introduction: “the end of geography…refers to a state of economic development where geographical location no longer matters in finance, or matters much less than hitherto” (1992).

Many scholars at the turn of 21st century, however, argued against this idea, either by establishing theoretical frameworks or by presenting relevant empirical evidence. Nevertheless, due to the very quick transformation in financial landscapes in the past few years, the previous literature more or less failed to include the latest developments in finance, including neither emerging financial institutions nor advanced financial activities, to test the notion of the end of geography. Therefore, this paper, incorporating the latest developments in the industry of finance in recent years, examines the relationship between finance and geography, with a focus on technology and geographical location, and argues that in the present day, finance doesn’t make geography increasingly insignificant for five reasons: 1) finance doesn’t change the social and economic landscapes of places; 2) the transmission of physical goods cannot catch up with the transfer of money and information; 3) different types of customers determine the importance of physical services; 4) finance depends on energy which is unevenly distributed in a geographical sense; and 5) the network of information is still locally divided. Nevertheless, in the future, there may be a trend in technology and related financial developments that makes geography less significant. In other words, the end of geography is still inconclusive today, but in the long run, the impact of technology on the power of geography may become clearer.

The rest of this article is structured as follows: after a brief introduction giving the definitions of technology and location in context, there are five sections analyzing the impact of technology on location from different perspectives. Each of the five sections corresponds to an argument that disputes the notion of the end of geography. Before the conclusion, a section that provides further thoughts and questions concerning this debate will be presented.

2. Definition and scope

Before elaborating on the relationship between technology and location, it is necessary to briefly define the scope of these two concepts. Technology in this context primarily refers to information and communication technology, which promotes the development of finance, such as the easy transfer of money and information or the popularization of internet-based finance. Location, on the other hand, includes the location of financial centers, firms and activities.

3. Unchanged landscapes of places

There are similar claims echoing O’Brien’s argument. For instance, Frances Cairncross (1997) puts forward the idea of “the death of distance,” which means that geography, especially distance and location, is no longer instrumental in finance.

However, both O’Brien (1992) and Cairncross (1997) only pay attention to the power of technology in making distance increasingly meaningless, and ignore the fact that the concrete landscape of a particular place, either social or economic, will not disappear even though the speed of finance communication makes the whole world much “smaller” (Martin, 1994). For example, the economic potential that has accumulated for decades in mega financial cities such as New York and Tokyo will not disappear even with the impact of information technology. In other words, the fundamental size, or capacity, of big financial centers, driven by well-developed infrastructure, huge population, and mature expertise of all kinds, is not easily altered by technology. If big financial centers remain mostly unchanged, they will still attract more capital, customers and financial services relative to small cities. So, geographical location is still important to financial institutions.

Moreover, besides economic capacity, culture is another important aspect of city landscapes. Although globalization supported by communication technology homogenizes the cultural landscape on a global level to some extent, it also, at the same time, reinforces the heterogeneity of different particular communities and helps maintain their unique cultural traits (Greig, 2002).

These points are well demonstrated by the theory of “convergence vs. divergence.” Specifically, the theory implies that under the shock of global financial integration, in addition to the creation of convergent forces represented by “centralization and concentration,” divergent forces, in the form of decentralization, will also be observed between different financial centers, which create incentives for financial centers to specialize and to strengthen their dominance in their regions (Martin, 1994). London, for example, didn’t exhibit dissolution or disintegration due to the emergence of “space of flows” at the end of 20th century, and it continues to serve as one of the premier financial centers of today’s world and a powerful attraction for capital (Thrift, 1994).

Therefore, the claim that the financial global integration is making geography insignificant is not tenable because the landscapes of places will not easily change even when hit by globalization, and the difference between big and small cities will remain with big cities still in the dominant position with regard to the location of financial centers.

4. Transmission of physical goods

The second reason why the amazing speed of information communication cannot completely reshape the geography of finance is that financial activities, more often than not, include the transmission of physical goods as well as information and money. Even equipped with the most advanced information technology, enabling the extremely fast transfer of money, financial institutions still cannot complete business transactions if the movement of physical materials does not match the movement of money and market information. Thus, I argue, places that are close to the production sites of raw materials or targeted populations are still more attractive to institutions that deal with physical objects. Even today, institutions dealing with objects that cannot be transmitted via the internet hold the opinion that “spatial proximity” is central when costs and benefits are calculated (Berry et al, 1997). Hence, for financial institutions, as long as the physical supply chain exists, the high speed of communication and information technology alone cannot diminish the importance of location and geography.

5. Types of customers

Thirdly, the types of customers and of some financial services mean that location should always be carefully considered by financial firms no matter how wide the range of choices made available by the development of information and communication technology. As Agnes (2000) emphasizes, the power of “local embeddedness” can be understood in two ways. First, network construction in the finance industry requires face-to-face communication, which necessitates choosing specific locations for financial services. Second, some kinds of financial services—those with a “relationship-based client orientation”—require meetings with different groups of clients with various demands across many areas. Specifically, banks are the classic example of financial institutions offering such services. They have to painstakingly choose the location of their branches, despite the fact that online banking via websites and the internet has become mainstream. This is because certain types of customers, especially those who are not highly educated, are still heavily dependent on face-to-face communication with bank staff. I will use the case of a wholesale market in Guangzhou, a major city in southern China, to further illustrate.

Shahe Clothing Wholesale Market, located in downtown Guangzhou, is one of three main wholesale distribution centers in South-eastern China and it attracts many customers from the Middle East and Africa every year (Yi, 2010). Sellers there depend on their businesses for a living, and most of them started their businesses early in their lives and never received much education. Although they have full access to banks and related services, the sellers are highly dependent on face-to-face communication with bank staff in order to complete basic business, including opening accounts and transferring money between accounts, because most of them lack internet expertise. Only when they see the handling of their money in a physical bank do they trust that the service has been successful. Therefore, even though many branches of large Chinese banks began to disappear in cities, several new branches recently emerged around the clothing wholesale market, catering to the huge population in-flow of poorly educated individuals with money, often in cash. This example also, to some extent, reflects the conflict between traditional wholesale economies and high-tech industries. As long as such a mismatch is not resolved, geography, particularly location, will always be part of the dynamic.

6. Energy support as prerequisite

The fourth reason I argue against the notion of the end of geography is that all financial operations have indispensable requirements. Even the latest and most popular financial activities have prerequisites they must take seriously, and one of them is energy. In other words, without a basic energy supply, some financial activities supported by even advanced information technologies cannot operate successfully. The implication is that the location of energy is crucial to the location of some financial activities, despite claims that finance is free from geography. Next, the case of bitcoin mining will be examined.

Bitcoin, the most popular cryptocurrency of the past few years, is a payment system based on a peer-to-peer (P2P) network (Brito and Castillo, 2013). Bitcoin mining refers to the process in which people “compile transactions into blocks and try to solve a computationally difficult puzzle” in order to earn bitcoins (Kelleher, 2018). Specifically, to get bitcoins, miners usually use bitcoin mining machines—computers equipped with mining chips—to compute and continue mined blocks. When many groups of people gather and compute together with their machines, they form a mining camp. Although it sounds like an automatic process that requires nothing but a computer with a chip connected to the internet, there is significant energy consumption because whether they use CPUs, GPUs, or application specific integrated circuits, mining machines always consume a huge amount of electricity. For instance, Antminer S9, the most efficient mining machine so far, consumes 1350 watts of electricity while operating, approximately the same as a hairdryer on its highest setting (Holger, 2018).

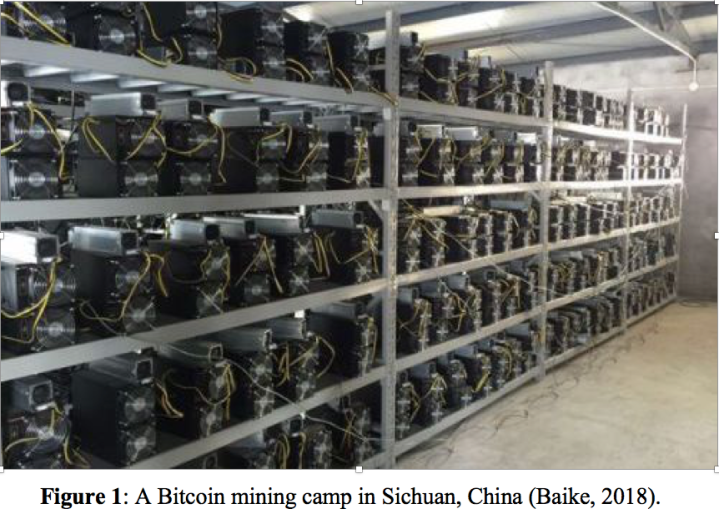

Therefore, in order to maximize their profits, miners desperately look for areas with low electricity costs to set up their mining camps. That’s the reason why every year, miners travel from all parts of China to the Sichuan Province, where electricity prices and population densities are low. Clearly, mining camps are no longer what we previously imagined them to be: collections of hundred-meters deep mines where gas lamps shine faintly and tons of coal are dug out. Now, mining camps are also thousands of machines lined up neatly in rows in temporary factories.

Looking at the phenomenon of Bitcoin, Elite Fixtures determined the cost of earning one bitcoin from mining in 115 different countries worldwide and the result is shown in the map below.

In South Korea it takes $26,170 to earn a single bitcoin, while in Venezuela it only takes $531. Thus, it is obvious that countries with low energy costs attract bitcoin mining activity, while high energy-cost countries are much less appealing.

In sum, although block chain and bitcoin mining are at the cutting edge of information technology and almost show that technology can impose the “end of geography”—anyone with a computer and software can participate independent of their location—even bitcoin cannot eliminate the social and economic differences between places (Agnew and Muscarà, 2012). In this case, the difference between electricity costs in different regions of the world leads to the uneven development of bitcoin-related financial activities across countries, which demonstrates that finance doesn’t make geography insignificant as financial activities depend on energy.

7. Financial information network at the local level

Although information technology enables market information to flow easily, the delivery and exchange of information are still heavily “geographically nested and segmented” because of the heterogeneity of market information (Clark and Wójcik, 2003). To put it another way, the improvement of information transmission doesn’t change the pattern of financial information networks that are still highly localized. Geography plays in important role in this pattern.

First, geography is important in determining the location of the production sites of financial instruments. Financial instruments, especially “opaque products” such as property trusts, which are based on the asymmetry of information and special expertise, are produced at the local level because opaque goods require highly private and secret information that is collected, evaluated, and transacted within local information networks, not global networks (Clark and O’Connor, 1997).

Second, even internet-based high-frequency trading (HFT) firms, which are famous for high speeds and high rates, geography is crucial because the main strategy of HFT—exploiting the price difference between exchanges “by exchanging information across hundreds of kilometers”—is arbitrage resulting from differences between local networks of information (Zook and Grote, 2016).

Therefore, information networks in different places retain a strong sense of locality, which makes geographical location very important.

8. In the long run?

All five arguments described above challenge the “end of geography” assumption that the “financial landscape is homogeneous” and support the claim that heterogeneity and anomaly are the true characteristics of the geography of finance (Laulajainen, 2003). However, it is valuable to take a long-term perspective and more farsighted to look past the arguments presented here because of the great potential for more technological advances. Therefore, in this section, I boldly look at the future and raise questions assuming that another wave of revolutionary technology and development will soon be under way.

First, what if major breakthroughs in areas such as railway and air transportation are realized, making the availability of raw materials and clients to small cities equal to that of big financial centers? Does that change the conclusion in the section “Transmission of physical goods”? It is difficult to predict the future but it seems that the geographical advantages of current financial centers will be weakened. Accordingly, finance will probably make geography increasingly insignificant when other kinds of technologies, especially transportation technology, catch up to the speed of money and information. Then they will together outline a scenario where physical geography no longer matters.

Second, if financial exclusion is effectively addressed by government policies and programs and financial literacy becomes universal in society, will the public’s successful mastering of basic financial skills enable the physical handling of financial services to disappear?

Third, the basic assumption in the section “Energy support as prerequisite” is that financial activities rely on energy, infrastructure, etc. Consequently, a similar question can be asked: if this assumption breaks down (i.e., financial technologies in the future are no longer or are much less dependent on natural energy), will it lead to the complete detachment of finance from physical geography? This question may reshape the financial landscape significantly.

Finally, it is interesting that the discussion in this section can also be thought of as describing some of the requirements necessary to bring about the end of geography in finance. The requirements include greater transportation development, more financial education, and most importantly, progress in financial technology advancement.

9. Conclusion

In conclusion, this paper looks at one of the core themes in “the end of geography” debate—the impact of information and communication technology on the location of financial institutions, firms and activities. It argues that in the present, finance is not making geography increasingly insignificant for five reasons. First, the difference in landscapes between big and small cities means that current financial centers still attract more capital relative to small cities. Second, financial institutions dealing with the transportation of physical goods still have to consider “spatial proximity.” Third, some types of clients exhibit needs that cannot be fulfilled through the internet so the location of financial firms has to be carefully selected to serve them. Fourth, financial activities still rely on supplies of energy, which are unevenly distributed across regions. Fifth, financial information networks are divided at the local level. Finally, a look at the relationship between technology and location in the long run indicates that if transportation technology, the universalization of financial education and financial technology reach a significantly high degree, finance may diminish the power of geography in the future.

10. References

Agnes, P. (2000). The “End of Geography” in Financial Services? Local Embeddedness and Territorialization in the Interest Rate Swaps Industry. Economic Geography, 76(4), pp.347-366.

Agnew, J. and Muscarà, L. (2012). Making Political Geography. Lanham: Rowman & Littlefield publishers.

Bitcoin Mining Machine_Baidu Baike. (2018). Retrieved from https://baike.baidu.com

Berry, B., Conkling, E. and Ray, M. (1997). The Global Economy in Transition. 2nd ed. Prentice Hall, New Jersey, pp.293-330.

Brito, J. and Castillo, A. (2013). Bitcoin: A Primer for Policymakers. Mercatus Centre, George Mason University.

Cairncross, F. (1997). The Death of Distance: How the Communications Revolution Will Change our Lives. London: Orion Business Books.

Clark, G. (2005). Money Flows like Mercury: the Geography of Global Finance. Geografiska Annaler: Series B, Human Geography, 87(2), pp.99-112.

Clark, G., Feldman, M. and Gertler, M. (2000). The Oxford Handbook of Economic Geography. Oxford and New York: Oxford Press.

Clark, G., & O’Connor, K. (1997). The Informational Content of Financial Products and the Spatial Structure of the Global Finance Industry. In K. Cox, Spaces of Globalization: Reasserting the Power of the Local (pp. 89-114). New York: The Guilford Press.

Clark, G. and Wójcik, D. (2003). An Economic Geography of Global Finance: Ownership Concentration and Stock-Price Volatility in German Firms and Regions. Annals of the Association of American Geographers, 93(4), pp.909-924.

Greig, M. (2002). The End of Geography? Globalization, Communications, and Culture in the International System. Journal of Conflict Resolution, 46(2), pp.225-243.

Grindsted, T. (2016). Geographies of High Frequency Trading – Algorithmic Capitalism and its Contradictory Elements. Geoforum, 68, pp.25-28.

Kelleher, J. (2018). Bitcoin Mining. Retrieved from https://www.investopedia.com

Laulajainen, R. (2003). Financial Geography: a Banker’s View. London: Routledge.

Martin, R. (1994). Stateless Monies, Global Financial Integration and National Economic Autonomy: the End of Geography?. In S. Corbridge, R. Martin & N. Thrift, Money, Power and Space (pp. 253-278). Oxford: Blackwell.

O’Brien, R. (1992). Global Financial Integration: the End of Geography. London: Royal Institute of International Affairs.

Thrift, N. (1994). On the Social and Cultural Determinants of International Financial Centres: the Case of the City of London. In S. Corbridge, R. Martin & N. Thrift, Money, Power and Space (pp. 327-355). Oxford: Blackwell.

Yi, C. (2010). Network-Marketing-Oriented Website Construction of Shahe Clothing Wholesale Market. Market Modernization, 15, p.52.

Zhao, X., Wang, T. and Zhang, J. (2002). Information Flow and Asymmetric Information as Key Determinants for Service and Financial Centre Development: a Case on Socialist China. Economic Geography, 22(4), pp.408-414.

Zook, M. and Grote, M. (2016). The Microgeographies of Global Finance: High-frequency Trading and the Construction of Information Inequality. Environment and Planning A: Economy and Space, 49(1), pp.121-140.